Foreign investors interested in setting up a company in Saudi Arabia can open a limited liability company, which is the most common way of doing business. Only one shareholder and one director are required to form a limited liability company (LLC). One of the main advantages of a Saudi Arabia limited liability company is that the shareholders of the company are only liable for debts incurred by the related business up to the amount of their equity stake in the company.

Saudi Arabian limited companies:

The Companies Law is the main law governing the formation of various legal entities, among which the Limited Liability Company is one of the most widely used laws in Saudi Arabia. There are two types of LLCs:

- The private limited liability company.

- The Public limited liability company.

Among them, private LLCs are the most common, as the registration process in the Saudi Companies Registry is quick and easy. It should be noted that the Companies Law was revised in 2015 and revised again in 2018.

According to the Law, the main characteristics of this legal form are the following:

- It has a different legal personality from the shareholders;

- According to the new law, the life of a company created in this way is limited;

- Some documents must be prepared when registering a limited liability company;

- The company must have a regional office in a city in Saudi Arabia;

- If the company is foreign-owned, it must obtain a special permit;

- The main requirement is that it must have at least one shareholder and one director.

limited liability company shareholders:

A limited liability company must have at least one shareholder (who may be a natural person or other legal entity) and at least one director. However, if the number of shareholders exceeds 20, a board of directors must be elected. Additionally, if the number of shareholders is at least 3, the LLC must establish a board to oversee the activities of the directors. In addition, the maximum number of members of this type of business is 50 people. Due to this new change in legislation, it should be noted that shareholders are no longer liable for the company’s debts if the company loses at least 50% of the share capital, as was the case before 2018.

Capital of LLCs in KSA:

Business forms in Saudi Arabia have different capital requirements, depending on local laws. Although the general rule is that no minimum share capital is required to form a limited liability company, certain conditions may apply depending on the company’s activities. For example, in 2024, the Saudi General Investment Authority (SAGIA) set a minimum share capital of SAR 1 million for a licensed limited liability company. In addition, Saudi LLCs must set aside 10% of their annual income in legal reserves. The LLC is the best option for foreign entrepreneurs who are considering moving to Saudi Arabia.

To know more informations about corporate taxes in Saudi Arabia.

How to determine the share capital of LLCs in Saudi Arabia:

Establishing share capital is an important step in setting up a company in Saudi Arabia. For a limited liability company (LLC), consider the following: If the LLC operates in the industrial or agricultural sectors, the minimum share capital requirements increase to USD 5 million (around SAR 1,333,000). LLCs wishing to obtain a SAGIA license must have a minimum share capital of SAR 500,000 (approximately USD 10,000).

To know about the procedure for establishing a Limited Liability Company(LLC) in Saudi Arabia.

Registration of LLCs in Saudi Arabia in 2024:

- One of the first steps to establishing a limited liability company in Saudi Arabia in 2024 is to obtain a company name, which must be registered with the Department of Trade and Industry.

- The formation process involves drafting the articles of association and submitting them to the United Nations Department of Companies under the Ministry of Trade and Industry for approval. The process can be completed online.

- Once the company’s statutes have been sealed by the service, they must be registered at the notary’s office. In addition, you need to open a bank account for the company, which can be activated after the company receives the registration certificate. This bank account is important to hold the company’s shares.

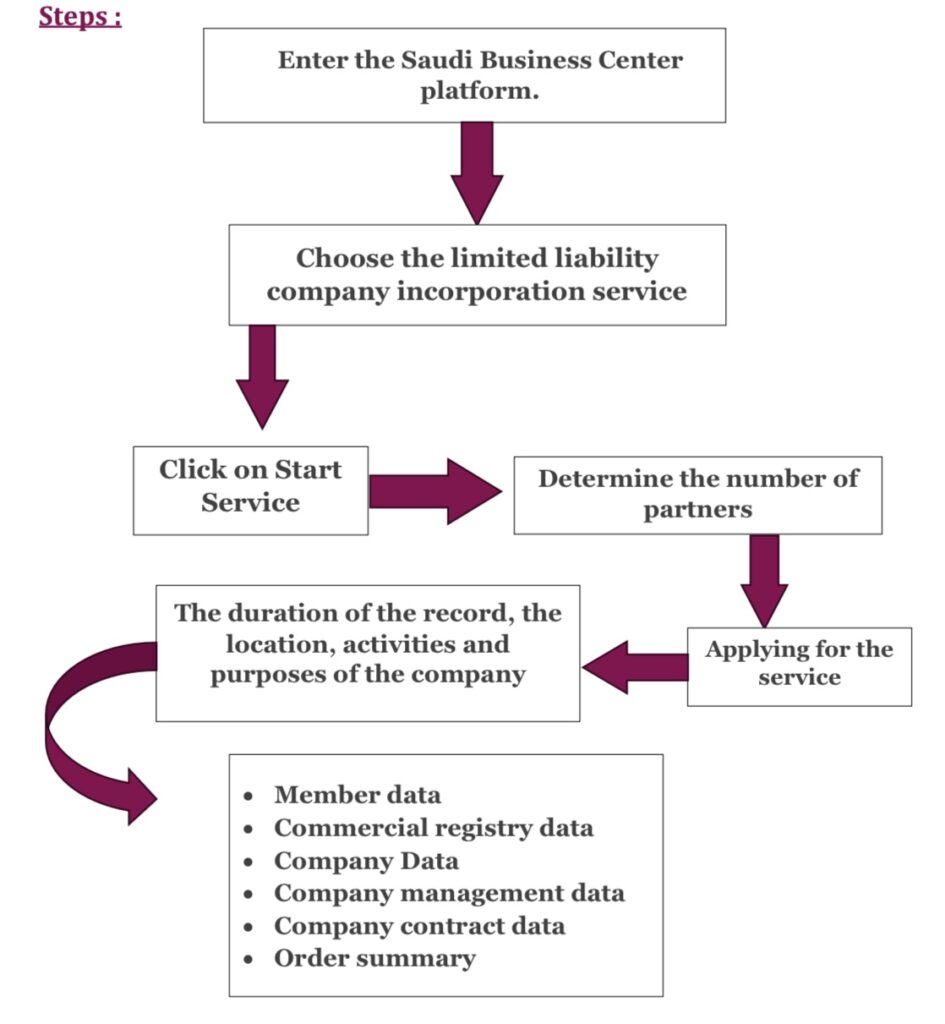

E-Services For Establishing Of A Limited Liability Company By Ministery Of Commerce:

This service allows investors to start a business activity and establish a limited liability company, which is constituted by one or more natural or legal persons who are responsible independently of the financial responsibility of each partner or owner, and the company is responsible for the result we obtain. take it in full. their responsibilities and obligations. or debts and obligations derived from its activities, for which its owners or partners are not responsible without the measure of their participation in the capital . and the service by the following is done :

- Issuance of commercial registry books and articles of the organization.

- Grant commercial license immediately (optional).

- Open an institution profile in the Ministry of Labor Affairs and Social Development.

- Record Zakat through Zakat e-portal, excise, and customs authorities.

- Registered in the General Social Security Agency.

- Registering with a domestic address at Saudi Post is the way to go.

- Register with the Chamber of Commerce by location.

This service is provided by the Saudi Business centre :

Conditions that must be met are imposed by the Ministry of Commerce:

- The age must not be less than 18 years. If the applicant is a minor, he/she must present a certificate of guardianship.

- The partners must not be government employees.

- The business registration cannot be suspended, suspended, or canceled if one of the partners is a business partner.

- If the type of business is (Professional) the following information must be verified:

- The partners have valid work permits.

- If the company is a joint venture, the proportion of authorized Saudi partners will not be less than 25%.

- The proportion of authorized partners will not be less than 70%.

Required documents:

- If one of the partners is a government agency, private institution, charity, or foundation, there is a legal document that gives it the right to form or participate in the company.

- A license from the Central Bank of Saudi Arabia is available if required for this activity.

Key Features of Business Laws Related to Limited Liability Companies:

The popularity of limited liability companies in the Saudi Arabian business sector is due to their attractive features in terms of efficiency and cost savings. This section highlights key aspects of Saudi Arabian business law related to limited liability companies (LLCs):

- Separate legal personality: LLCs have a separate legal personality from that of their shareholders. Limited duration: The new law limits the lifespan of a company incorporated as an LLC.

- Document requirements: Several documents are very important in the LLC registration process.

- Local office authorization: The LLC must have a local office in a city in Saudi Arabia.

- Foreign ownership license: If the business is foreign-owned, you must obtain a special license.

- Minimum requirements: Basic requirements include at least one partner and one director.

In conclusion:

The entrepreneurial journey is full of uncertainties and challenges and requires an informed assessment of existing complex business structures. While LLCs offer a variety of benefits, from asset protection to operational flexibility, potential entrepreneurs should proceed with caution and approach them with wisdom and foresight. By charting a course through the complexities of legal issues and financial opportunities, entrepreneurs can embark on a journey of change and move forward with confidence and conviction.

References:

- Ministry of commerce, Establishment of A limited liability company. Retrieved from: https://mc.gov.sa/en/eservices/Pages/ServiceDetails.aspx?sID=99#:~:text=This%20service%20enables%20the%20investor,and%20obligations%20arising%20from%20it .

- Amin Elsaghir , 2023, start a limited liability company in Saudi Arabia . Retrieved from: https://www.linkedin.com/pulse/start-limited-liability-company-saudi-arabia-amin-el-saghir-ec4wf?utm_source=share&utm_medium=member_ios&utm_campaign=share_via.